What is the leverage effect?

If you are thinking about investing your money, you should find out about it in detail. There are a few tricks you can use to make your investment particularly successful. One instrument that investors use to increase returns is the leverage effect. However, this is not without risk if it is unstable, which is why real estate could be an interesting investment for you as a stable capital investment.

The leverage effect explained simply

The word “leverage” comes from the English and means “lever”. As in physics, a leverage effect is used to increase the return on equity, or at best even multiply it. In this case, the financing costs of debt capital on the return on equity serve as leverage. So if you take out debt capital, for example in the form of a loan, the return on equity can increase significantly.

Function of the leverage effect

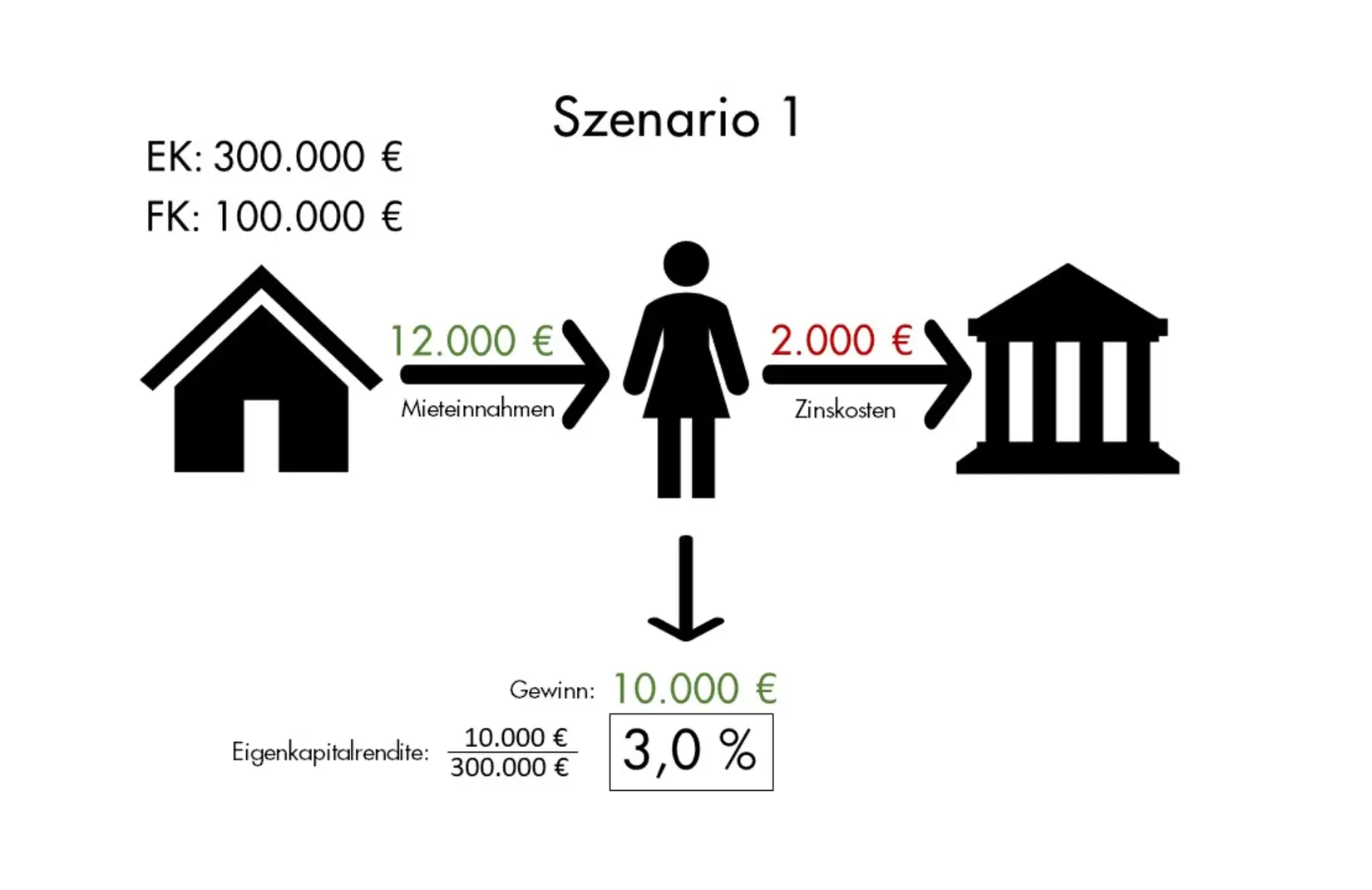

Imagine that you decide to invest in an apartment that is already rented out or to buy an empty apartment and rent it out. The purchase price is 400,000 euros and the future basic rent is 1,000 euros. To simplify the example, ancillary costs are not taken into account. If the annual rental income is set in relation to the purchase price, this results in a gross initial yield of 3.0 %. The prerequisite for this is that it is rented out over the entire period. In a first scenario, you use EUR 300,000 of equity to purchase the property and take out a loan with an interest rate of 2.0 % for the rest. If you now compare the annual rental income with the cost of the loan, this results in a profit of EUR 10,000 on the equity. Your return on equity is therefore around 3.0%.

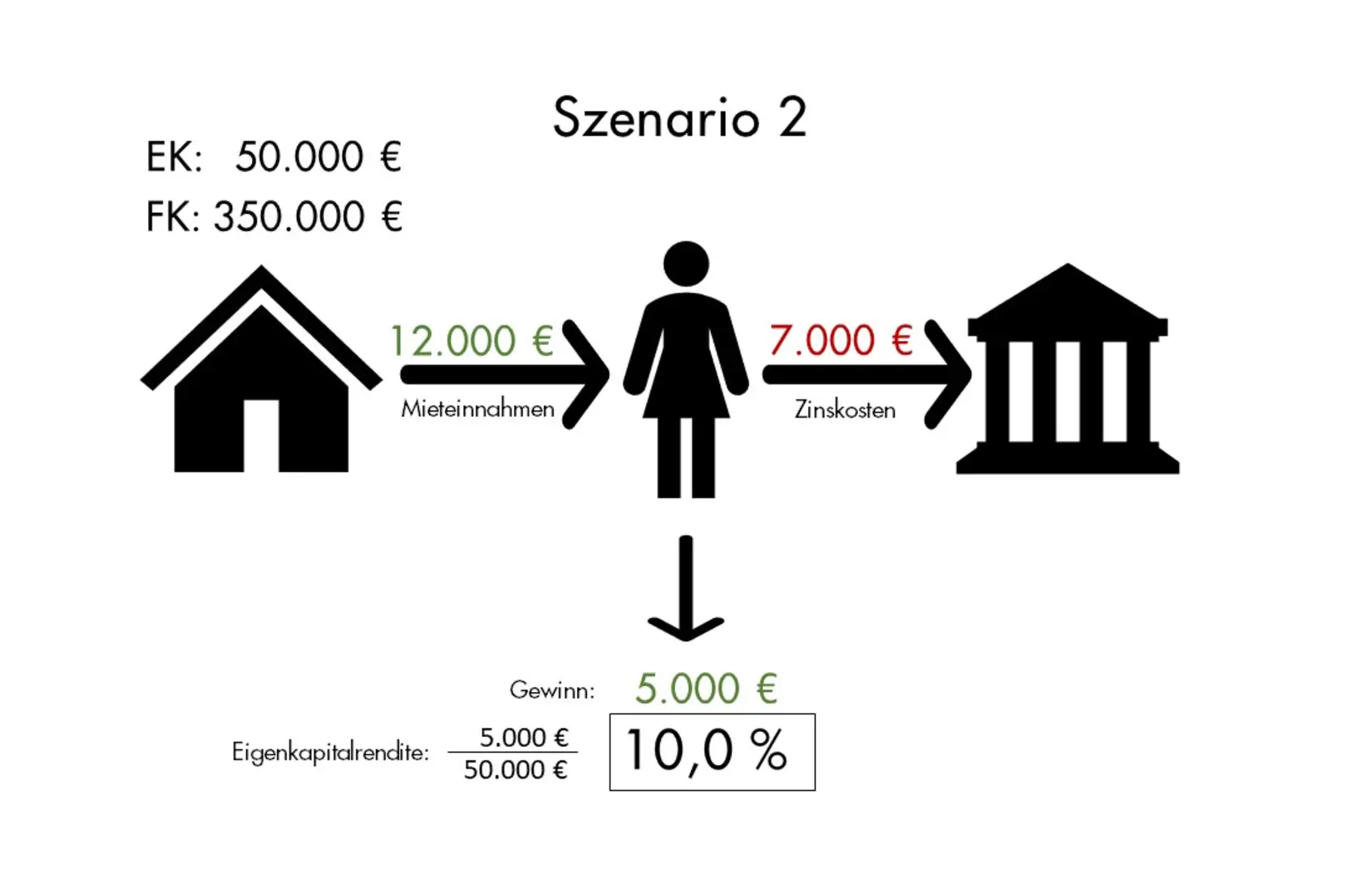

The second scenario changes the initial situation in that you take out a larger loan and only use 50,000 euros of equity for your investment. The interest rate on the loan remains at 2.0%. You can therefore expect a profit of 5,000 euros on the equity, which results in a return on equity of as much as 10 %. So if you increase the proportion of borrowed capital, there is actually an opportunity to increase the return on equity considerably.

The value of a property

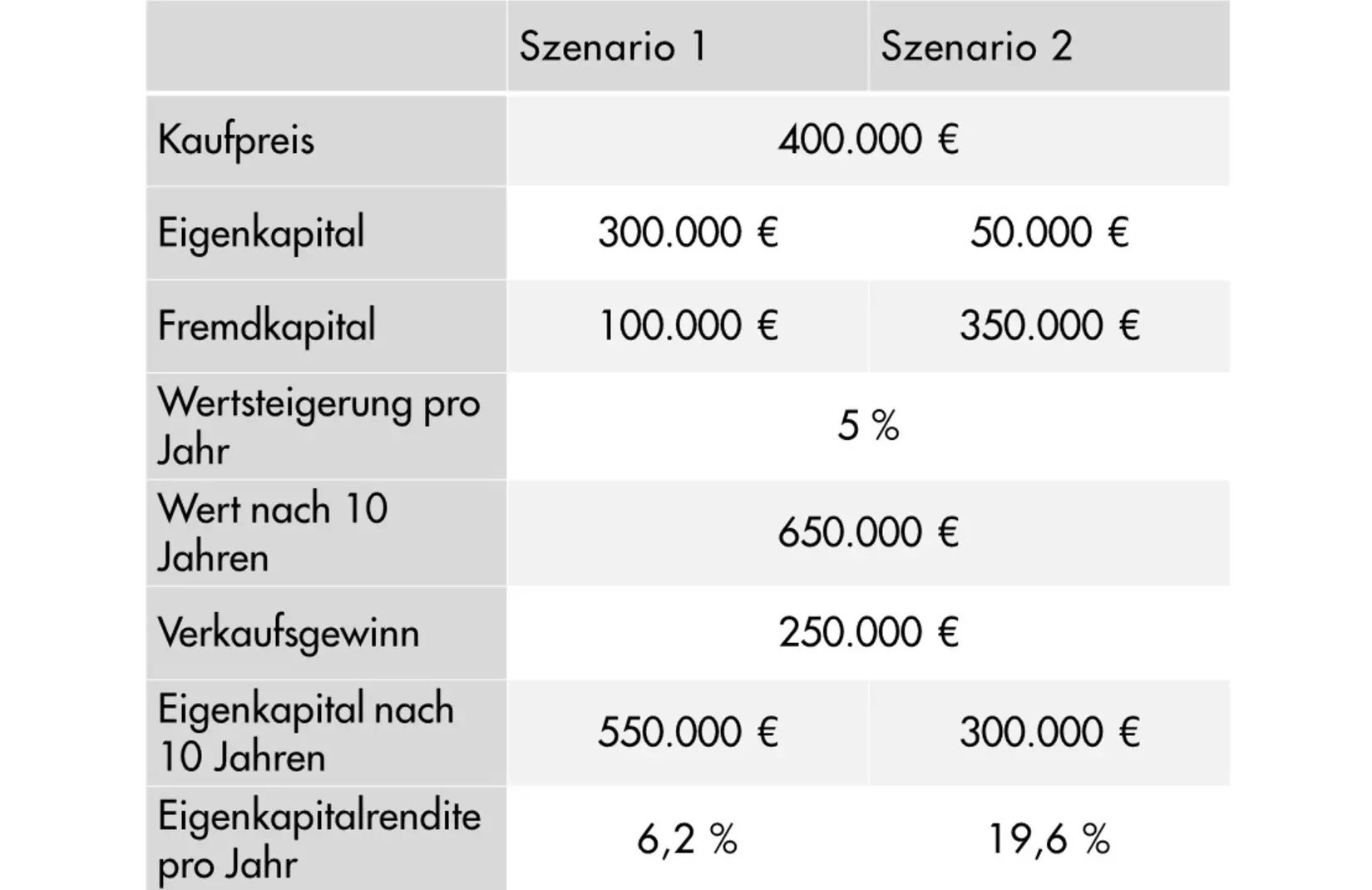

So far, the performance of the property has gone unnoticed. This has a decisive influence when leverage comes into play. The use of borrowed capital can also boost profits here. In conjunction with the basic assumptions of the scenarios listed above, this can be clearly seen. If we assume an annual increase in value of 5.0 % and, for the sake of simplicity, ignore ancillary costs, rental yield and repayment, the return on equity in scenario 1 is 6.2 %. At the same time, the return on equity in the second scenario is significantly higher at 19.6 % due to the higher proportion of borrowed capital. In this case too, more debt capital would make the investment much more promising.

Leverage effect - opportunities and risks

However, certain risks must not go unmentioned. In the example calculations, the ancillary costs have been neglected for illustrative purposes. Possible maintenance and repair costs, for example, can be high and should be taken into account in comprehensive calculations. In addition, the costs must always be covered for financing purposes. This requires a guarantee that the apartment will always be rented out. In any case, it should also be noted that the expected total return on capital is greater than the interest on borrowed capital. In relation to the example described above, this means that the return on the apartment should always be higher than the interest rate on the loan so that no losses are made at this point.

The greatest risk is probably a loss in value. In this unfavorable case, the leverage effect would also occur and significantly increase the losses. The more debt capital you invest in the property, the higher your risk. According to current developments, however, this is not necessarily to be expected, especially in booming cities such as Leipzig or Berlin. A long-term increase in value is currently much more likely, which makes real estate a very attractive investment. If you have any further questions on this topic, our team of experts will be happy to advise you at any time.