At home in a new building

The thought of buying a new-build apartment and being the first occupant of a completely untouched home triggers something in us. For many, it is a long-cherished dream. However, there are significant differences between buying a new property and buying a property that has been there for some time, which we would like to summarize for you below.

Purchase before start of construction

A new-build apartment can be purchased at virtually any stage of development, although it is not uncommon for sellers to offer them before construction has even started. In this case, prospective buyers often make their decision on the basis of drafts and renderings of potential designs. This leaves considerable scope for design, with future residents usually even having a say in the floor plan. Plans and documents should therefore be checked thoroughly beforehand. However, there is protection against deviations in the finished apartment from the original agreements. In serious cases, you can even instruct the builder to make changes to the initial plans. Even if construction is already at an advanced stage at the time of purchase, there are still options for customizing the apartment. While the floor plan can still be adapted in some cases, buyers are often given the opportunity to choose between different fittings, furnishings and appliances.

Design defects

One potential disadvantage of a new build is that, particularly in the first three years, minor construction defects such as cracks or damp in the walls may occasionally become apparent. This sometimes makes reworking necessary. However, property developers usually provide a five-year (or longer) guarantee to cover these so that buyers do not have to bear the costs themselves.

Have you already found your dream property and are looking for suitable financing?

Then don't hesitate and contact us today. Our experienced financial advisors will work with you to develop the perfect form of financing for you and provide you with competent and transparent support right from the start.

Missed completion dates

Even with the best-laid plans, deadlines are sometimes missed – an unavoidable fact that could delay your move into your new home. However, depending on the stage of construction and the length of the delay, you will receive financial compensation for each month you miss the deadline.

Energy efficiency

An often overlooked advantage of new-build apartments is the compliance of heating systems, windows and insulation with the standards stipulated by the German Energy Saving Ordinance (EnEV). They apply to all new builds and guarantee that your energy bills will be lower than for existing buildings. However, your new home could be even more energy efficient than the regulation requires. Such sustainable homes require innovative heating technologies based on renewable energies such as solar, geothermal, biomass, wood, wind, hydropower and very good thermal insulation. Although their construction costs are higher than those of “normal” buildings, you could benefit from a low-interest subsidy program from the Kreditanstalt für Wiederaufbau (KfW). Loans of €100,000 are available on favorable terms – the better the energy standard, the higher the repayment bonus.

High resale value

Another financial incentive for anyone considering buying a new build home is the fact that new builds have a higher resale value than older ones. This means that buying a brand new home, designed to your exact specifications, can be worthwhile in terms of profitability, despite paying a premium. Newly built properties are also seen as better collateral by banks, which means you could benefit from more favorable terms when financing your new home.

Financial double burden

However, there can still be financial disadvantages to buying a new-build apartment. One is easier to overlook than you might think: if you buy an apartment before it is completed, you will be paying for it while you are still living in your old one. It may be worth talking to a financial advisor to help you deal with this double burden.

Commitment interest

Normally, the contract with the developer of a new build allows you to make payments on account in different construction phases. In this case, the agreed loan amount is not required in full, but in installments. However, you should include one important cost component in your considerations: the commitment interest. This is a fee that the lender charges the borrower as compensation for his loan commitment. As the creditor has already set aside the funds although he cannot yet charge interest, he charges the commitment interest. However, this fee is usually only charged after a certain period of time, which, like the amount of interest, can vary greatly from case to case. The maturity period varies from two to 24 months and the average amount is three percent per year, which corresponds to 0.25 percent per month.

Are you interested in attractive real estate in Berlin, Leipzig and the surrounding area?

Then contact us now with no obligation. Get an overview of our extensive portfolio and let us advise you personally so that you too can find your dream property.

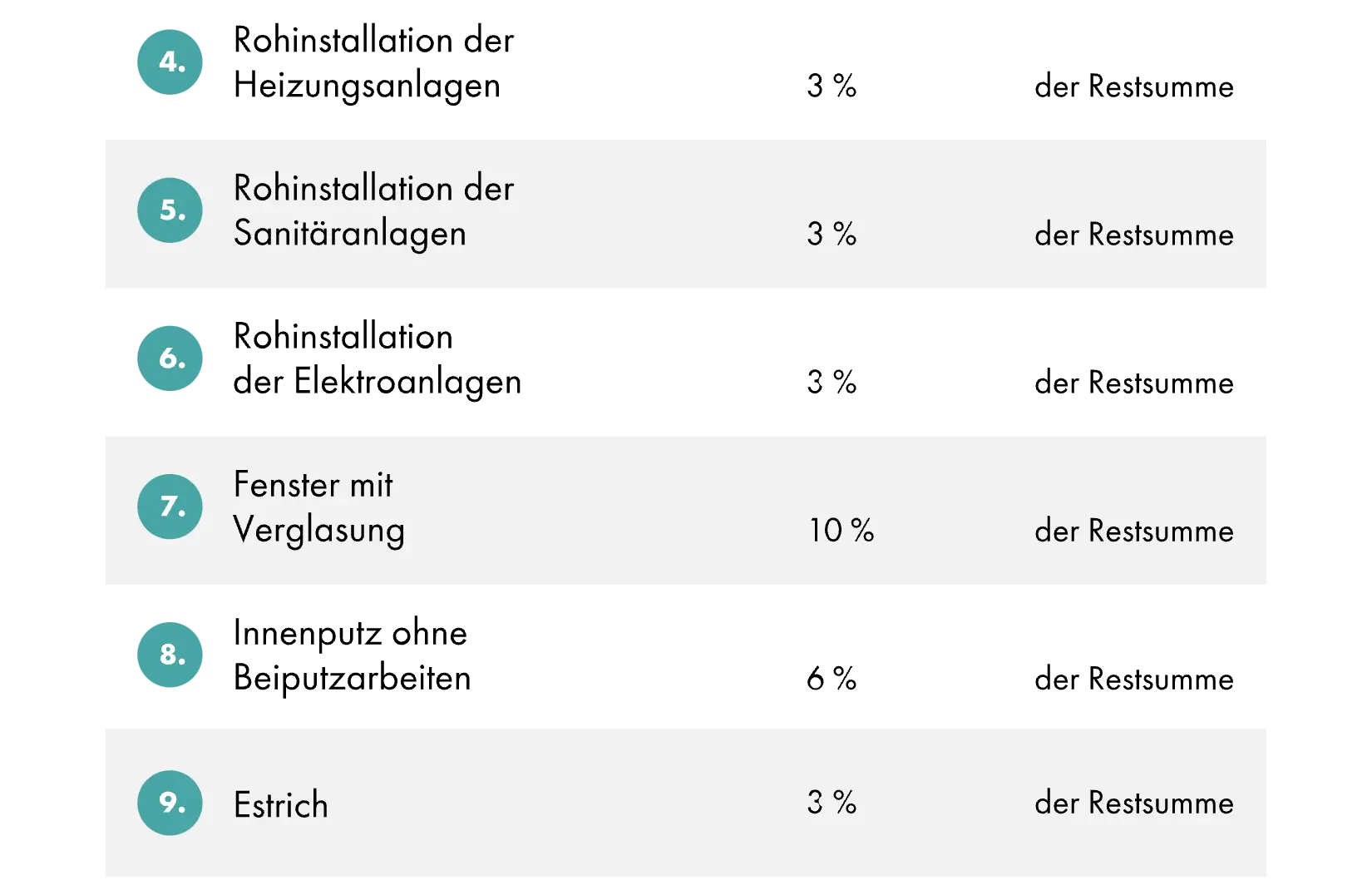

Payment plan

As already mentioned in the previous paragraph, there is usually a payment plan for the payment of the purchase price for a new-build apartment. This is structured in accordance with the provisions of the Real Estate Agent and Property Developer Ordinance (MaBV). This ordinance lists a total of 13 different construction phases. However, these may not be billed individually by the developer, but in a maximum of seven installments. While the first installment depends on when the property is purchased, buyers make the remaining payments as construction progresses.